Indiana State Tax Rate 2025. The annual salary calculator is updated with the latest. The annual salary calculator is updated with the latest income tax rates in indiana for 2025 and is a great calculator for working out your income tax and salary after tax based on a.

Indiana annual salary after tax calculator 2025. The in tax calculator calculates federal taxes (where applicable), medicare, pensions plans (fica etc.) allow.

On our 2025 state business tax climate index, a study that evaluates the competitiveness of states’ tax structures across more than 120 tax policy variables,.

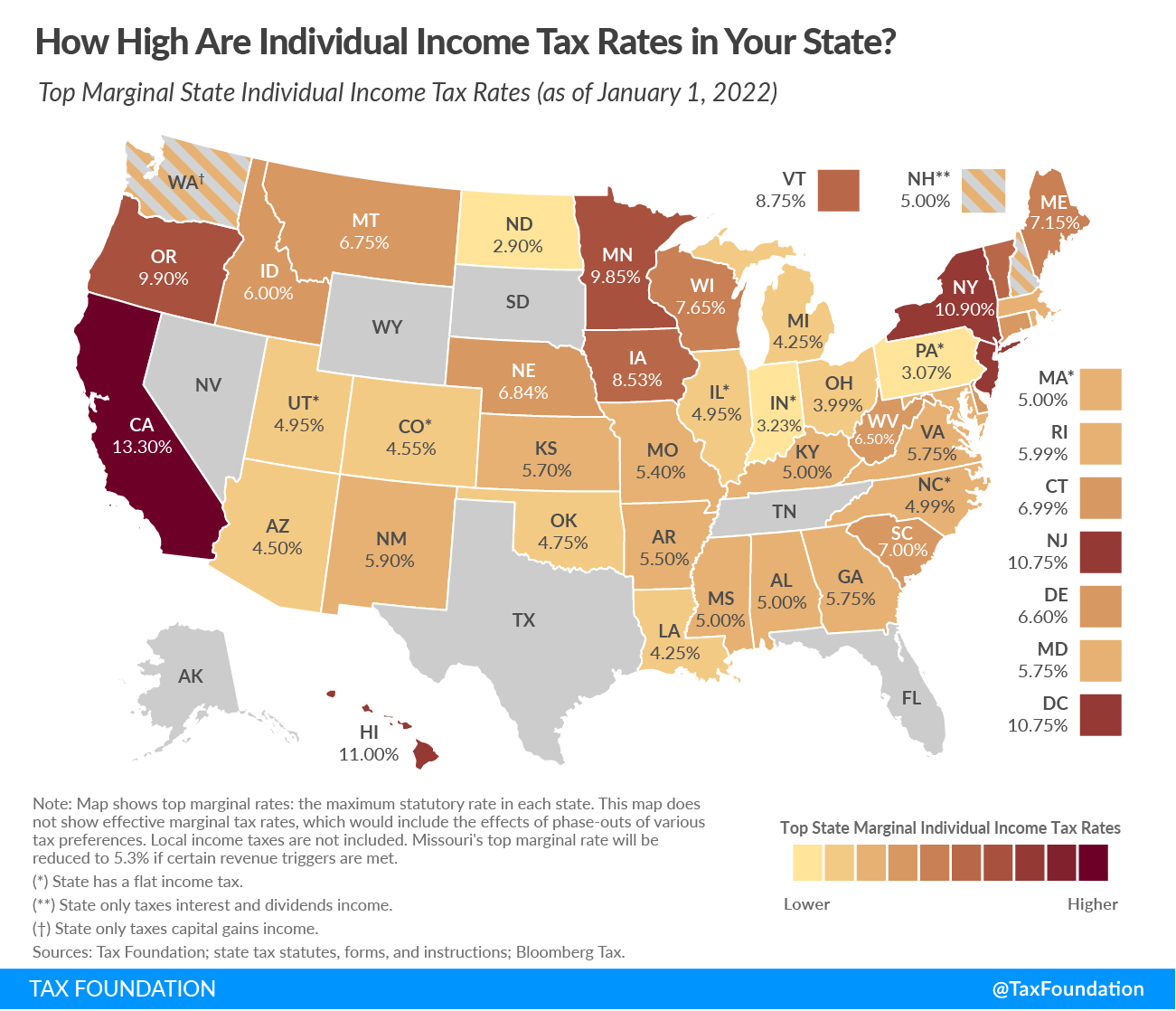

Ranking Of State Tax Rates INCOBEMAN, On our 2025 state business tax climate index, a study that evaluates the competitiveness of states’ tax structures across more than 120 tax policy variables,. The tax tables below include the tax rates, thresholds and allowances included in the indiana tax calculator 2025.

Tax rates for the 2025 year of assessment Just One Lap, The indiana department of revenue issued updated guidance on how to compute withholding for indiana state and county income tax, reflecting legislation enacted in 2025. Marginal tax rate 3.23% effective tax rate 3.18% indiana state tax.

Indiana State Tax Withholding Calculator Internal Revenue Code, If you need an extension to file your state. Exact tax amount may vary for different items.

Allen County Indiana Property Tax Bills, The individual income tax rate has been reduced from 3.15 percent to 3.05 percent in 2025, with further reductions to 3.0 percent in 2025, 2.95 percent in 2026, and. Indiana has a flat statewide income tax of 3.15% for tax year 2025, which falls to $3.05 in 2025.

Indiana Local County Taxes Taxed Right, On our 2025 state business tax climate index, a study that evaluates the competitiveness of states’ tax structures across more than 120 tax policy variables,. Some jurisdictions collect local income taxes.

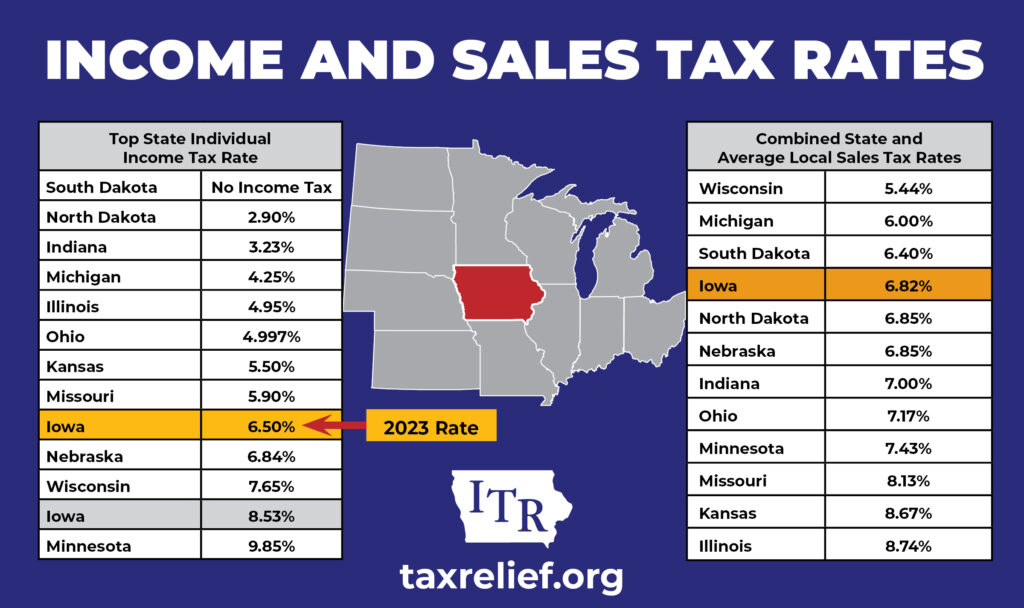

Midwest State and Sales Tax Rates Iowans for Tax Relief, If you need an extension to file your state. December 21, 202317 min read by:

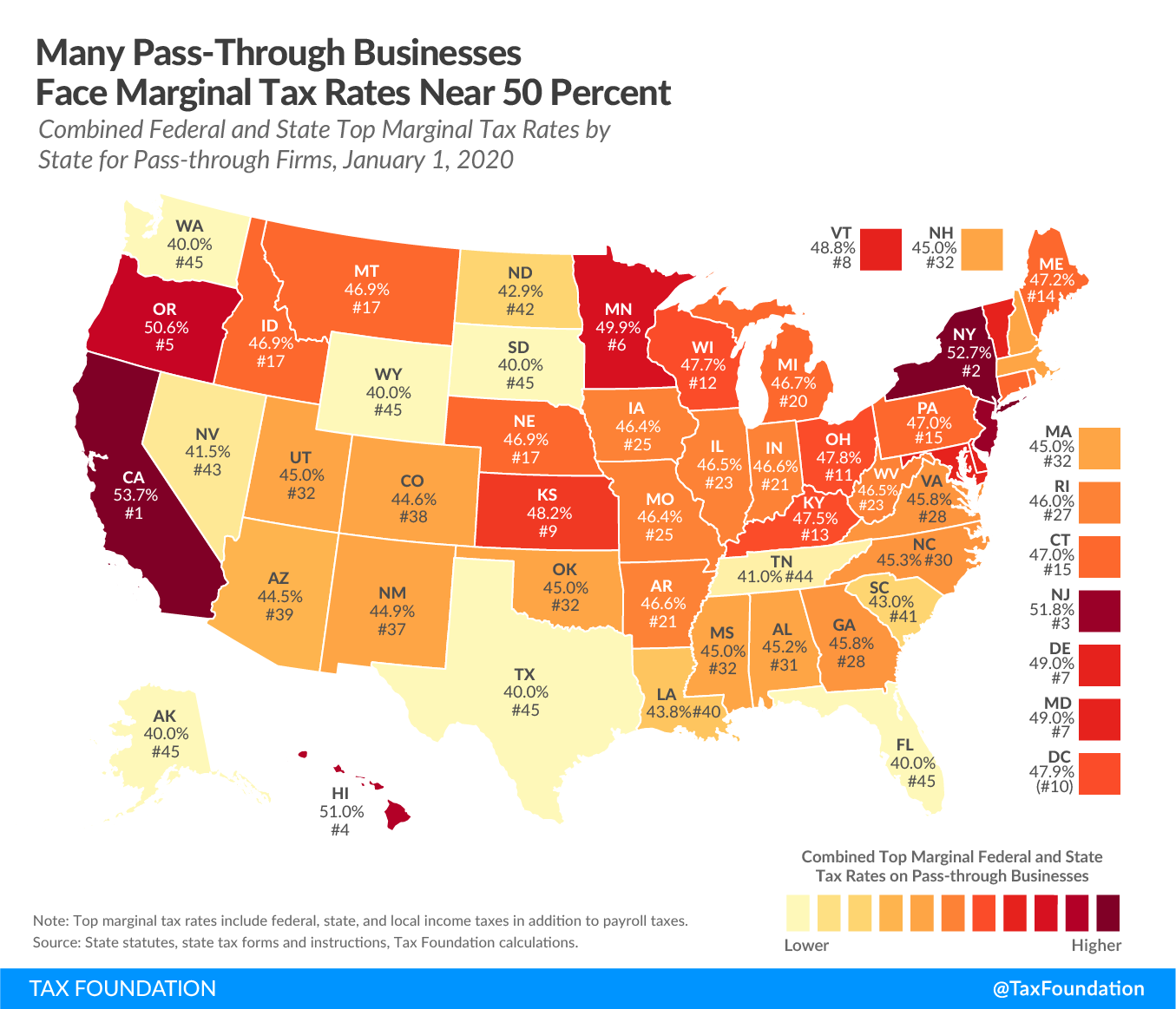

Marginal Tax Rates for Passthrough Businesses by State Upstate Tax, Indiana had a flat 3.15 percent individual income tax rate for tax year 2025, which covers taxes being filed in 2025. 15 — an additional six months — to file your return.

Taxes By State 2025 Dani Michaelina, Indiana annual salary after tax calculator 2025. This is up by about 10.6% from $2.4153 a gallon in the previous period, according to state records.

The Best States to Start a Business in 2025 Forbes Advisor, The indiana department of revenue issued updated guidance on how to compute withholding for indiana state and county income tax, reflecting legislation enacted in 2025. If you request an extension with the irs, you'll have until oct.

州のガス税率州のガス税ランキング、2025年7月Tax Foundation Promo Integra, If you request an extension with the irs, you'll have until oct. Indiana has a flat statewide income tax of 3.15% for tax year 2025, which falls to $3.05 in 2025.

1001, enacted in may 2025, indiana accelerated its previously enacted tax rate reductions, lowering the individual income tax rate from 3.15 in 2025 to.

The indiana individual adjusted gross income tax rate for 2025 is 3.15% and will adjust in 2025 to 3.05%.